July 2019

- Rachel Paul

- Jun 27, 2020

- 6 min read

Tax day might seem far away, but waiting until year-end to make your tax moves may prove costly to you. Maximizing your tax savings starts with an effective mid-year strategy! Detailed here are some ideas to kick-start your summer tax planning. This issue also includes some unique and free summer travel destinations, an infographic with key IRS audit information, and five steps to help your business set the right salaries for your employees.

Call if you would like to discuss how this information relates to you. If you know someone who can benefit from this newsletter, feel free to send it to them.

CONTENTS

Effective Tax Planning Starts Now!

Can't Miss Stops for Your Summer Road Trip

What You Need To Know About IRS Audits

Make Setting Salaries Easier With These 5 Steps

Effective Tax Planning Starts Now!

With summertime activities in full swing, tax planning is probably not on the top of your to-do list. But putting it off creates a problem at the end of the year when there’s little time for changes to take effect. If you take the time to plan now, you’ll have six months for your actions to make a difference on your 2019 tax return. Here are some ideas to get you started.

1. Know your upcoming tax breaks. Pull out your 2018 tax return and take a look at your income, deductions and credits. Ask yourself whether all these breaks will be available again this year. For example:

Are you expecting more income that will bump you to a higher tax rate?

Will increased income cause a benefit to phase out?

Will any of your children outgrow a tax credit?

Any changes to your tax situation will make planning now much more important.

2. Make tax-wise investment decisions. Have some loser stocks you were hoping would rebound? If the prospects for revival aren’t great, and you’ve owned them for less than one year (short-term), selling them now before they change to long-term stocks can offset up to $3,000 in ordinary income this year. Conversely, appreciated stocks held longer than one year may be candidates for potential charitable contributions or possible choices to optimize your taxes with proper planning.

3. Adjust your retirement plan contributions. Are you still making contributions based on last year’s limits? Maximum savings amounts increase for retirement plans in 2019. You can contribute up to $13,000 to a SIMPLE IRA, up to $19,000 to a 401(k) and up to $6,000 to a traditional or Roth IRA. Remember to add catch-up contributions if you’ll be 50 by the end of December!

4. Plan for upcoming college expenses. With the school year around the corner, understanding the various tax breaks for college expenses before you start doling out your cash for post-secondary education will ensure the maximum tax savings. There are two tax credits available, the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit. Plus there are tax benefits for student loan interest and Coverdell Savings accounts. Add 529 college savings plans, and you quickly realize an educational tax strategy is best established early in the year.

5. Add some business to your summer vacation. If you own a business, you might be able to deduct some of your travel expenses as a business expense. To qualify, the primary reason for your trip must be business-related. Keep detailed records of where and when you work, plus get receipts for all ordinary and necessary expenses!

Great tax planning is a year-round process, but it’s especially effective at midyear. Making time now not only helps reduce your taxes, it puts you in control of your entire financial situation.

Can't Miss Stops for Your Summer Road Trip School is out, the weather is warm, and it’s time to head out on a summer road trip! Tired of the same old locations? Every state has a number of unique destinations for the every day explorer. Here are some free ideas for the creative vacation seeker in all of us:

The World’s Largest Yard Sale. Stretching 690 miles through six states, the World’s Largest Yard sale includes over 2,000 vendors. Every year at the beginning of August, you can drive for four days (from Addison, Michigan to Gadsden, Alabama) in search of second-hand treasures. Along the route are more than 35 major vendor stops. These stops include groups of at least 25 sellers clustered together. But you can also find sales in individual yards, garages, parking lots or even right on the side of the road.

The Wave Organ. Located in San Francisco, California, the Wave Organ is a sprawling sculpture that incorporates multiple pipes that enter the ocean at different levels to create musical tones when they’re struck by the waves. The sculpture itself is made of granite and marble from an old cemetery. When planning a visit, shoot to be there during high tide when the organ is at its best.

Miss Crustacean Hermit Crab Beauty Pageant. Do you have a hermit crab that really likes to flaunt its shell? Then Ocean City, New Jersey is the place for you! Every August, contestants vie for the Coveted Cucumber Rind Cup by showcasing their elaborately decorated hermit crabs. Registering your charming hermit crab is free — just make sure you get there early.

Carhenge. If you don’t have time to travel across the ocean to see Stonehenge, you’re in luck! Head to Alliance, Nebraska to visit Carhenge instead. Built in 1987 as a replica of the iconic stone circle in England, Carhenge uses vintage cars as building blocks instead of the 25-ton stones used in the original. It’s located in the middle of farmland and includes a walking path with some other, let’s just say, interesting sculptures.

The Austin bats. Hidden under the Congress Avenue Bridge in Austin, Texas from late March until early fall lives the largest urban colony of Mexican free-tailed bats in the world. At its peak, (sometime in August) the colony has as many as 1.5 million bats! Every night around sunset, onlookers pack the bridge, sidewalks and river below to experience the colony taking flight in search of insects. If you decide to watch from the water, you might want to bring an umbrella — unprepared spectators are known to be hit with guano (AKA bat poop)!

Hitting the road is a great way to spend some time with loved ones this summer. Adding quirky stops that will be remembered for a lifetime make it even better!

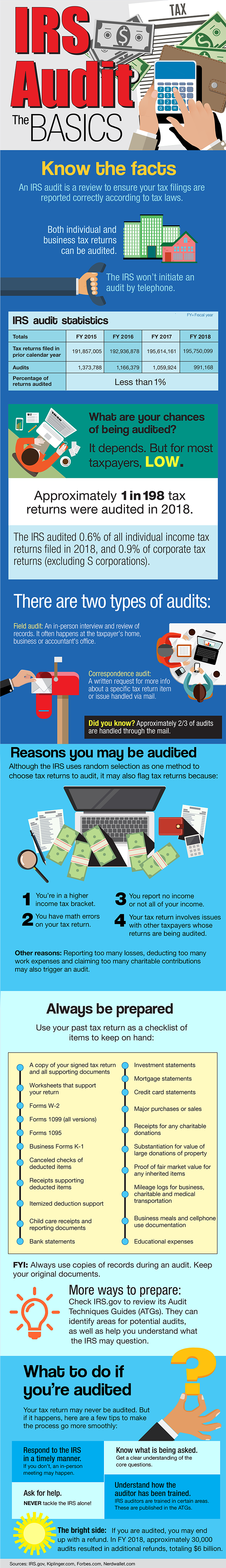

What You Need To Know About IRS Audits The IRS recently released its 2018 Data Book, including information on its audit activities for the last fiscal year. This infographic details what you need to know regarding your audit risk, how to prepare for and what to expect in an IRS audit.

Make Setting Salaries Easier With These 5 Steps Whether you are hiring for the first time, filling an open position, or conducting annual performance reviews, finding a salary range that attracts and retains valued employees can be a difficult task. Here are some suggestions to help make the process a bit easier for you and your company:

Know what your business can afford. Like any business expense, you need to know how it will affect your budget and cash flow. Make a twelve-month profitability and cash forecast and then plug in the high end of the annual salary range you are considering to see if it’s something your business can absorb. After all, the greatest employee in the world can’t help you if you don’t have the money to pay them. Don’t forget to account for increases in benefit costs, especially the escalating cost to provide healthcare. Once you establish a budget, you can allocate your spending plan to your payroll.

Understand the laws. In general, the federal government sets the minimum requirements (minimum wage of $7.25 per hour, overtime rules and record keeping requirements). States and localities often add their own set of rules. For example, the state of Illinois, Cook County and the city of Chicago all have different minimum wage requirements. If you are located in Chicago you need to adhere to the highest rate. So research all payroll rules that apply to your location at the beginning of the process. When reviewing the rules, don’t forget that different rules often apply depending on the number of employees in your business.

Review and update job descriptions. Take some time to review key jobs and update them as appropriate. With new positions, note the exact tasks and responsibilities you envision for the role. Then, think about the type of person that will succeed performing these responsibilities. Once you have a clear picture of who you are looking for, you can begin to build a detailed job description and narrow in on a specific salary range.

Establish value ranges and apply them. Value is key when determining the perfect salary amount. Define the range of value for the position and then apply that valuation to the current person’s performance within the defined pay range. Use websites and recruiters to establish the correct range of pay, then apply experience and employee performance to obtain a potential new salary amount. Remember, size of company, location and competitiveness of the job market are all factors to consider.

Factor in company benefits. A strong suite of employee benefits is a powerful tool to couple with a competitive salary. Don’t be afraid to communicate their value to prospective and current employees (they help with retention, too!). According to Glassdoor, health and dental insurance are the most important, but flexibility is close behind - over 80 percent of job seekers take flexible hours, vacation time and work-from-home options into consideration before accepting a position.

Finding the right salary can be tricky, but with some preparation and research, you can find the balance that satisfies the needs of your business and your employees.

Comments